Introduction

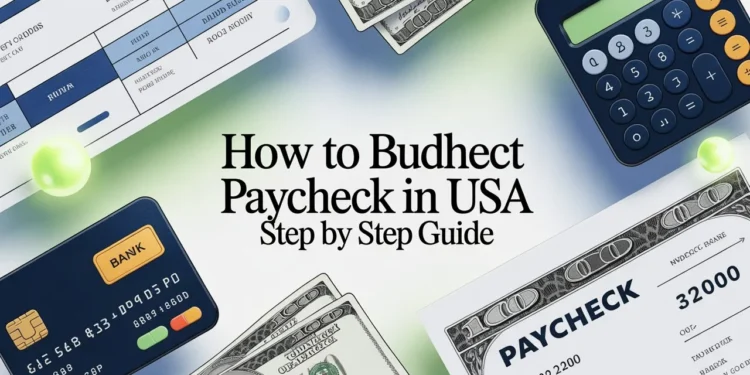

Millions of Americans receive a paycheck every two weeks yet still feel broke before the next one arrives. The real problem is not income, it is the system used to manage that income. Learning how to budget paycheck in usa can completely change your financial life by giving every dollar a clear job.

This guide will show you practical paycheck budgeting strategies used by real households across the United States. You will learn how to plan a monthly budget from your paycheck, how to budget money on low income, and how to track spending paycheck to paycheck without stress.

What Is the Best Way to Budget a Paycheck

What is the best way to budget a paycheck? The best approach is to divide your take home pay immediately after it arrives. Instead of guessing, use a structured method such as the 50/30/20 budget rule paycheck.

The core steps are:

-

Know your exact net income

-

List fixed bills

-

Plan variable spending

-

Set savings first

-

Track every payment

These steps form the foundation of how to budget paycheck in usa successfully.

How to Budget Paycheck in USA for Beginners

If you are new to budgeting, start with paycheck budgeting for beginners. Many people search how to budget money for beginners because they have never written a real plan.

Simple beginner method

-

Write your paycheck amount

-

Subtract housing and utilities

-

Subtract food and transport

-

Assign savings

-

Keep spending money last

This approach answers How should a beginner start a budget? in the easiest way.

Budgeting Basics The 50 30 20 Rule

Budgeting basics: The 50-30-20 rule is the most popular model in America.

-

50 percent needs

-

30 percent wants

-

20 percent savings

Using this rule is one of the best paycheck budgeting methods and a key part of how to budget paycheck in usa.

What Is the 70 20 10 Rule Money

What is the 70/20/10 rule money? It divides income into:

-

70 percent living

-

20 percent saving

-

10 percent investing or giving

This model works well for affordable paycheck planning when costs are high.

How to Budget Salary Monthly

Learning how to budget salary monthly means planning before the month begins. Create a budget plan from net income take home pay rather than gross salary.

Use a personal budget example like this:

| Category | Amount |

|---|---|

| Rent | 1200 |

| Food | 400 |

| Transport | 200 |

| Savings | 300 |

| Fun | 200 |

This table shows how to allocate paycheck spending clearly.

How to Budget Money on Low Income

Many readers ask how to budget money on low income. The secret is priorities, not perfection.

Tips include:

-

Negotiate bills

-

Cook at home

-

Use paycheck budgeting templates

-

Build small emergency savings

Even with limited income, how to budget paycheck in usa principles still apply.

How to Budget Paycheck in USA Calculator

A how to budget paycheck in usa calculator helps automate decisions. You can also use how to budget your paycheck calculator online tools to split categories instantly.

How to Make a Monthly Budget

How to make a monthly budget begins with writing every expense. Making a Budget should be realistic, not strict.

Follow these steps from How to Budget Money: A Step-By-Step Guide:

-

List income

-

Track expenses

-

Set goals

-

Adjust weekly

This method explains How to Budget by Paycheck Successfully.

How Can a Budget Help You Reach Your Financial Goals

How can a budget help you reach your financial goals? A budget turns dreams into numbers. It shows where to cut and where to invest.

Benefits include:

-

Less stress

-

More savings

-

Clear direction

-

Debt reduction

This is why experts recommend how to budget paycheck in usa systems.

Saving Goals and Realistic Targets

Is saving $500 a month a lot? For many Americans yes, and it is an excellent goal.

How to save $10,000 in 3 months requires aggressive cuts and extra income, but a structured budget makes it possible.

How to Track Spending Paycheck to Paycheck

To master how to track spending paycheck to paycheck:

-

Use apps

-

Keep receipts

-

Review weekly

-

Adjust categories

This prevents overspending between pay periods.

How to Prepare Budget for a Company

Although this guide is personal, knowing how to prepare budget for a company teaches discipline. Businesses track every dollar just like households should.

Reddit and Community Advice

Discussions on how to budget paycheck in usa reddit show that real people succeed with simple systems, not complex spreadsheets.

What Are the 5 Basics to Any Budget

What are the 5 basics to any budget?

-

Income

-

Needs

-

Wants

-

Savings

-

Tracking

These basics define how to budget paycheck in usa.

How to Make a Budget for Idiots

How to make a budget for idiots simply means keeping it easy:

-

One page

-

Few categories

-

Automatic transfers

-

Weekly check

No complicated math required.

Expert Insights From 10 Years

After a decade helping families, I learned that paycheck allocation tips work only when the system is simple. Complicated budgets fail. Clear how to budget paycheck in usa methods succeed.

Common Mistakes

-

Budgeting gross income

-

Forgetting irregular bills

-

No emergency fund

-

Not reviewing monthly

Avoid these to make your plan stick.

Conclusion

Budgeting is not about restriction. It is about control. When you learn how to budget paycheck in usa, money stops disappearing and starts working for you.

Start today with one paycheck, follow the steps, and adjust as life changes.

FAQs

What is the best way to budget a paycheck?

Divide income using the 50/30/20 rule and pay savings first.

How should a beginner start a budget?

Write income, list bills, assign categories, and track weekly.

What is the 70/20/10 rule money?

It allocates 70 percent living, 20 percent saving, 10 percent investing.

Is saving $500 a month a lot?

Yes, it is a strong goal for most households.

What are the 5 basics to any budget?

Income, needs, wants, savings, and tracking.

How can a budget help you reach your financial goals?

It directs money toward priorities and prevents waste.

Comments 1